2019-Big Island Year End Real Estate Summary

Welcome to my year end 2019 summary of real estate news and trends for my December blog and newsletter readers. The good news is…it’s all good news! Properties in all categories are selling well along the Kohala Coast especially condominiums. The least expensive condominium units with the most bedrooms are the “hot ticket” in all resorts. Land and developed lots continue to be great buys if you have the time and patience for the building process. Single family homes are the next best bargain per square foot but an overall more expensive option to condominiums mainly because of their larger size. Most of my comments and analysis concern the Kohala Coast Resorts and not the north Kona Resorts and communities such as Kohanaiki, Kukio and Hualalai.

The Kohala Coast resort market for condominiums +/- $1m is really good with an average days on market of less than 90 days if the unit is priced no higher than a few percentage points beyond the sold price of the last, best comparable unit. Price and condition are “99%” of the selling process in all classes of real estate especially in the low appreciation market we find ourselves in 2019/2020. There is no pushing the market upward in price 10-20% when the next unit is listed. This will result in long days on market and probably a lower sales price if the property was listed correctly from the beginning.

Most resort condominiums in the South Kohala market are selling for 2006/2007 prices currently or lower in some cases. My own personal home in The Villages at Mauna Lani was valued at $1.25m in 2006 as I listed and sold the adjacent unit for that price in 2006. It may be worth $875k now if I decided to sell. There are many other communities in all of the Kohala Coast resorts which have not recovered from the Great Recession starting in 2009 making current purchases relative bargains and accounting for no new inventory being built in most resorts. It’s my opinion that current condominium pricing would need to increase at least +20% to allow developers enough margin to start new construction ventures.

Please read the rest of this post for more changes caused by the new Short Term Vacation Rental policies adopted into law in 2019. These will have a profound effect on purchasing trends in the future and values also in the Kohala Coast Resorts. I’ve included some useful statistics from area experts, our MLS system and National sources for comparison.

In 2020 I believe we will continue the current trend of moderate appreciation on Hawaii Island (+/- 4%) in most real estate categories except land and developed lots where high construction costs continue to reduce land values. I also believe mortgage interest rates will remain near all time lows for most of 2020. That is pretty good news for most of us here on Hawaii Island within the Kohala Coast Resorts.

Thanks for reading this post. Happy Holidays and have a great beginning to 2020!!

Aloha,

Rick Oliver

RB-18823

Clark Realty LLC

hawaiiluxuryresortproperties.com

Hawaii and National Economic Trends

Low National Inflation Rates

The annual inflation rate for the United States is 2.1% for the 12 months ended November 2019, compared to 1.8% previously, according to U.S. Labor Department data published December 11, 2019.

Source: https://www.usinflationcalculator.com/inflation/current-inflation-rates/

Low Unemployment for State of Hawaii and Nation

Hawaii – The Hawai‘i State Department of Labor & Industrial Relations (DLIR) today announced that the seasonally adjusted unemployment rate for October was 2.7 percent, for the third consecutive month. Statewide, 643,700 were employed and 17,700 unemployed in October for a total seasonally adjusted labor force of 661,400. Nationally, the seasonally adjusted unemployment rate was 3.6 percent in October, compared to 3.5 percent in September.

Source: https://www.hiwi.org/admin/gsipub/htmlarea/uploads/LFR_LAUS_PR_current.pdf

National – THE EMPLOYMENT SITUATION, NOVEMBER 2019 – Total nonfarm payroll employment rose by 266,000 in November, and the unemployment rate was little changed at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care and in professional and technical services. Employment rose in manufacturing, reflecting the return of workers from a strike. 8:30 a.m. (EST) Friday, December 6, 2019.

Source: https://www.bls.gov/news.release/pdf/empsit.pdf

Low Long Term Mortgage Interest Rates

The average 30-year fixed mortgage rate rose 3 basis points to 3.93% from 3.90% a week ago. 15-year fixed mortgage rates rose 3 basis points to 3.26% from 3.23% a week ago.

Source: bankrate.com 12/10/19

High Building Costs and Long Lead Times for New Construction Statewide

Honolulu has 4th highest building cost in the world as of May 2019.

Market Trends in and Around the Resorts

-

New regulations of Short Term Vacation Rentals (STVR) could be steering buyers to Resort (V) markets where they are permitted and away from Residential (R) zoned properties where a Special Use Permit will now be needed. A negatively affected area near the Resort (V) zones could be Waikoloa Village where a Special Use Permit is now required. Agricultural areas are specifically excluded from STVR except on lots permitted prior to 1974 but only with a Special use Permit. A negatively impacted community may be Kohala Ranch located in an Agricultural (AG) zone and where many owners were vacation renting previously. In past years, buyers have purchased less expensive properties outside of the Resort (V) zones but nearby and enjoyed premium, daily, vacation rental rates but now will be limited in most cases to long term, 30 day or more rents which are typically 50-60% lower than vacation rental rates. New STVR regulations will change the “value” calculation in these non-resort zoned areas for buyers seeking to vacation rent their properties possibly driving prices down in these Residential (R) or Agricultural (AG) zoned properties. That being said, the lower demand by those seeking to vacation rent could be offset by local buyers purchasing these Residential (R) zoned properties to owner occupy. Current, positive economic conditions affecting local buyers include low unemployment (-3%), high, long term rental rates and finally very low, long term mortgage rates (-4%). All of these factors are conducive for local buyer’s purchasing island wide. It will take until the end of 2020 to verify if a downward drift in average sales prices occurs in Residential (R) and Agricultural (AG) zones especially near the Resort (V) zones.

-

Developed lots in all zoning classifications continue to be inexpensive as construction cost are high driving lot/land prices lower in and around the Kohala Coast Resorts (V) The lot cost plus current building costs of a new home can exceed the current “Market” value in some cases by 20%+ making the purchase of a well priced existing new or newer property a much better value. In addition, the building process could take as much as 24 months including obtaining all approvals and development of the building plans by the architects and engineering consultants which can discourage buyers from considering the “buy a lot and build a house” scenario.

-

Kohala Coast Condominiums in Resort (V) zoning, $400k- $1m with 3 bedrooms or more will continue to be strong sellers. The relatively low price enables the owners to obtain low cost and long term mortgages. Buyers continue to seek the most bedrooms in a particular price range as they know their vacation rental guests pay by the amount of sleeping accommodations and not necessarily for view or quality of construction. In other words, the price a buyer may pay for a condominium does not necessarily increase their vacation rental income as vacation renters are primarily considering the amount of sleeping accommodations first followed by location. Most vacation rental guests do seek a particular location or resort and some may pay a nightly premium for a good view of the ocean or golf course. As an example, within the Mauna Lani Resort, the private beach club is available to all owners and their rental guests as cost is already included in the owner’s community fee. This is a huge draw for vacation rental guests especially those who have been to the Mauna Lani previously therefore a positive amenity for owners. The Mauna Kea/Hapuna Beach owners can provide their vacation rental guests beach access through either hotel but first have to join The Club at a certain membership level to be able to offer this amenity to their vacation rental guests. Beach access for the Waikoloa Beach Resort is at “A” Bay which allows public access for everyone.

Currently the least expensive 2-3 bedroom plans can be found in the Waikoloa Beach Resort followed by the Mauna Lani Resort. Currently, the community with the least expensive cost per square foot, largest lanais, dedicated, 2-car garages and best quality are found at The Villages at Mauna Lani. The Maile plan units can be purchased for $1m+ and offer 2750 s/feet plus, 3-large lanais, outdoor kitchen and expansive, 2-car garage.

-

Kohala Coast Single Family Homes in Resort (V) zoning – Existing single family homes in the Kohala Coast Resorts continue to be a good value. Prices start at +/- $1000/SF including the fee simple land cost which in some cases is much less than the combined cost of an undeveloped lot and building costs of a new home. The cost of a single family home’s insurance, landscape, swimming pool and exterior maintenance can be less expensive than a condominium’s monthly association fee especially those on smaller lots. Nohea at Mauna Lani’s solid stucco, “right” sized homes are good examples of high-quality, resort styled properties on 1/3 acre lots for ease of landscape and property maintenance.

Aina Malu in the Waikoloa Beach Resort offers single family homes priced from $1m that affords buyers a somewhat inexpensive entry point into the resort market where the home can be vacation rented. These homes sizes range from 1647—2800 SF with 2-car garages and on a scale of 1-10 in quality are a 4-5 in my opinion. The location within the Waikoloa Beach Resort and ability to vacation rent add the majority of their value.

-

Mauna Lani Resort – Auberge Hotel Re-Opening. The former Mauna Lani Bay Hotel will re-open in January featuring fewer rooms and a reported $200m renovation. The owners investments should pay off not only for themselves in increased revenue and property value but for the community owners within the Mauna Lani Resort also. Here is the last communication from the Auberge management to the Mauna Lani owners:

Aloha Kākou,

As we continue our profound journey towards Mauna Lani’s highly anticipated debut later this year as an Auberge resort, I’m delighted to share the latest news taking place here at the hotel property. Mauna Lani is nearing its completion of an exciting renovation. The all-new, re-imagined luxury hotel will boast contemporary new guest rooms and suites, five private bungalow residences, three distinct pools (adults-only, family and resort style pool), a signature spa and fitness center, the KAINALU Sports program, and the educational Holoholo Kids Crew.

Additionally, Mauna Lani will feature five extraordinary restaurants and lounges – including the return of the iconic CanoeHouse. The new restaurants will include HāLani, Hā Bar, and The Market, offering a culinary destination like no other.

The hotel is also pleased to debut the interactive and immersive Living Culture program led by Danny Akaka, in his newly appointed role of Kahu Hānai. Now in its 22nd year, Danny will also continue the monthly tradition of Twilight at Kalāhuipua’a for guests and residents alike to enjoy long into the future.

These exciting new additions, along with the return of the most beloved aspects of the property, will be anchored by our incredible team who are finally returning home. On behalf of our ‘ohana, we are deeply committed to the people, this special place, and maintaining the warmth and inherent spirit of hospitality one feels here. Mauna Lani, Auberge Resorts Collection will officially open to the public on January 15, 2020. I look forward to welcoming you to Mauna Lani!

With warm aloha,

Sanjiv Hulugalle

Vice President and General Manager – Mauna Lani, Auberge Resorts Collection

Statistics

YOY-2019 Multiple Listing Statistics Summary as of November 30, 2019

| Hawaii Island Condominiums | # of Units SOLD Change Year Over Year % | Median Price Change Year Over Year | Sales Volume change Year Over Year |

|---|---|---|---|

| North Kona | 10.31% | 6.7% | 7.05% |

| South Kohala (Resorts) | 1.08% | 0.86% | -10.26% |

YOY-2019 Multiple Listing Statistics Summary as of 11-30-19

| Hawaii Island Single Family | # of Units SOLD Change Year Over Year % | Median Price Change Year Over Year | Sales Volume change Year Over Year |

|---|---|---|---|

| North Kona | 5.92% | 0.85% | 18.57% |

| South Kohala (Resorts) | -0.79% | 0.17% | -12.83% |

| North Kohala | 10% | -4.32% | 2.53% |

YOY-2019 Multiple Listing Statistics Summary as of 11.30.19

| Hawaii Island Land | # of Units SOLD Change Year Over Year % | Median Price Change Year Over Year | Sales Volume change Year Over Year |

|---|---|---|---|

| North Kona | 12.37% | 12.9% | 107.27% |

| South Kohala (Resorts) | -18.84% | 8.98% | -41.58% |

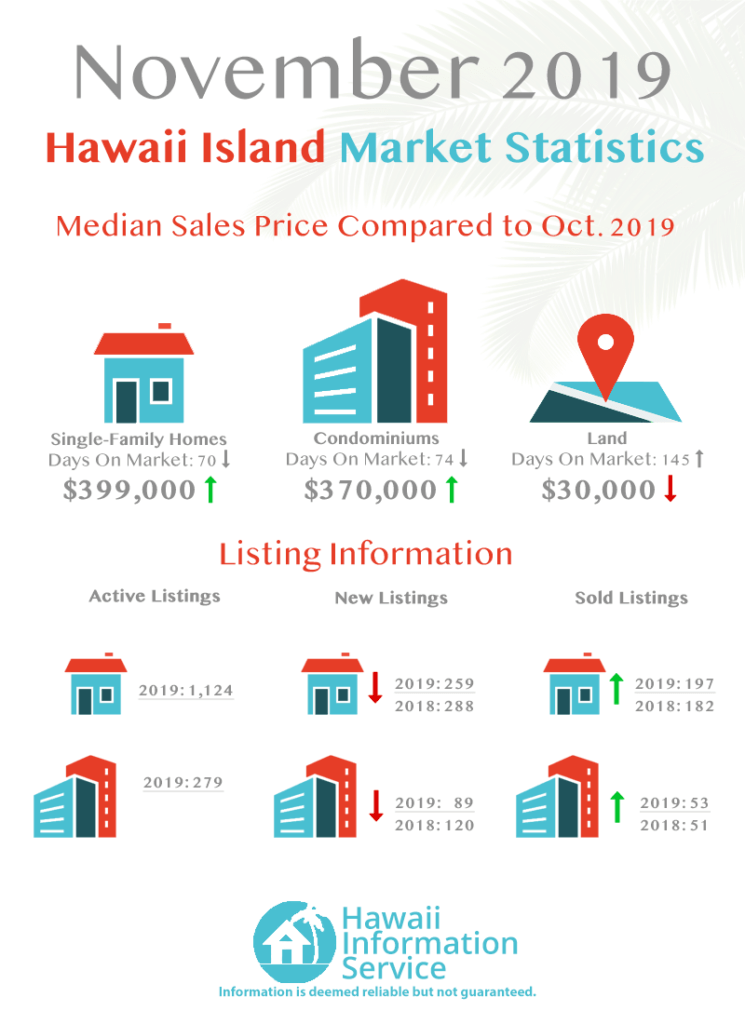

Click Here for the Full Report Report-Hawaii Information Services

Grigg’s Report, November 30, 2019

- The Condo stats continue to be strong with a Pending Ratio in Sellers’ Market territory at 71. Median Prices are showing +6%. year/year increase. The inventory of active condos under $1.5M is down 17% from last year.

- Like Residential and Condo, the Land stats show a shrinking inventory also. The continued strong sales numbers will certainly contribute to further decline in inventory and price pressure. Median Price has turned positive after many months of showing decline. It continues to be up by the greatest year/year change we have seen since recovery began ( +12%). Like Residential and Condo the pending sales declined some from a year ago.

- Page 6 is the Pending Ratio Summary page. This page offers a quick glance of the Pending Ratio trend for N. Kona Res., Condo, Land and Hawaii Island. In this report we see a strong year over year improvement in all categories except land.

- The Page 7 Kona Residential Price chart since 1972 has been updated with the new 2018 data. This maintains a data pool of similar homes many of which were new sales or have resold over the years. The total number of sales that make up the data pool now stands at 7,644 in the 23 subdivisions in the study. The year/year price change for this Mid-level housing group for 2018 is $615,100, up from 2017’s $587,100. This represents a 5% price increase for 2018.

- The Kona vs. West Coast section shows San Diego price appreciation is now leading most other West Coast metros with a + 2.7% year/year appreciation. It appears that the metros that have had the greatest price run ups over the past few years are now showing the least amount of appreciation. For example, San Francisco is showing a modest +1.7%. The point being that this may be one of the reasons there is only ½ % increase in Kona. The good news is the San Diego market is doing well and that is generally the leading indicator for the future of Kona price trends.

The Griggs Report is published semi-monthly by Michael B. Griggs, PB, GRI

Core Logic

The CoreLogic HPI Forecast indicates that home prices will increase by 5.4% on a year-over-year basis from October 2019 to October 2020. On a month-over-month basis, home prices are expected to increase by 0.2% from October 2019 to November 2019. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

The housing market benefitted during 2019 from mortgage and unemployment rates both below 4%, the first time this has happened in the post-World War II era. In 2020 we expect more of the same: while economic growth will likely be slower than during 2019, it will be sufficient to continue sub-4 readings for mortgage and unemployment rates.

Rising home prices will create more home-equity wealth in 2020, helping to sustain consumption spending. It also means that overall delinquency and foreclosure rates will likely remain at or below current levels, already the lowest in more than 20 years.

We expect more housing starts in 2020 than in 2019, but these new homes will generally add supply in the higher price and rent buckets, not in the less expensive tier. In part, this reflects the rising costs of labor, land and materials, which have risen about twice as fast as inflation over the last three years. (Exhibit 2) Our CoreLogic Construction Cost data have found each major material cost has outpaced inflation since 2016, and this trend is expected to continue next year.

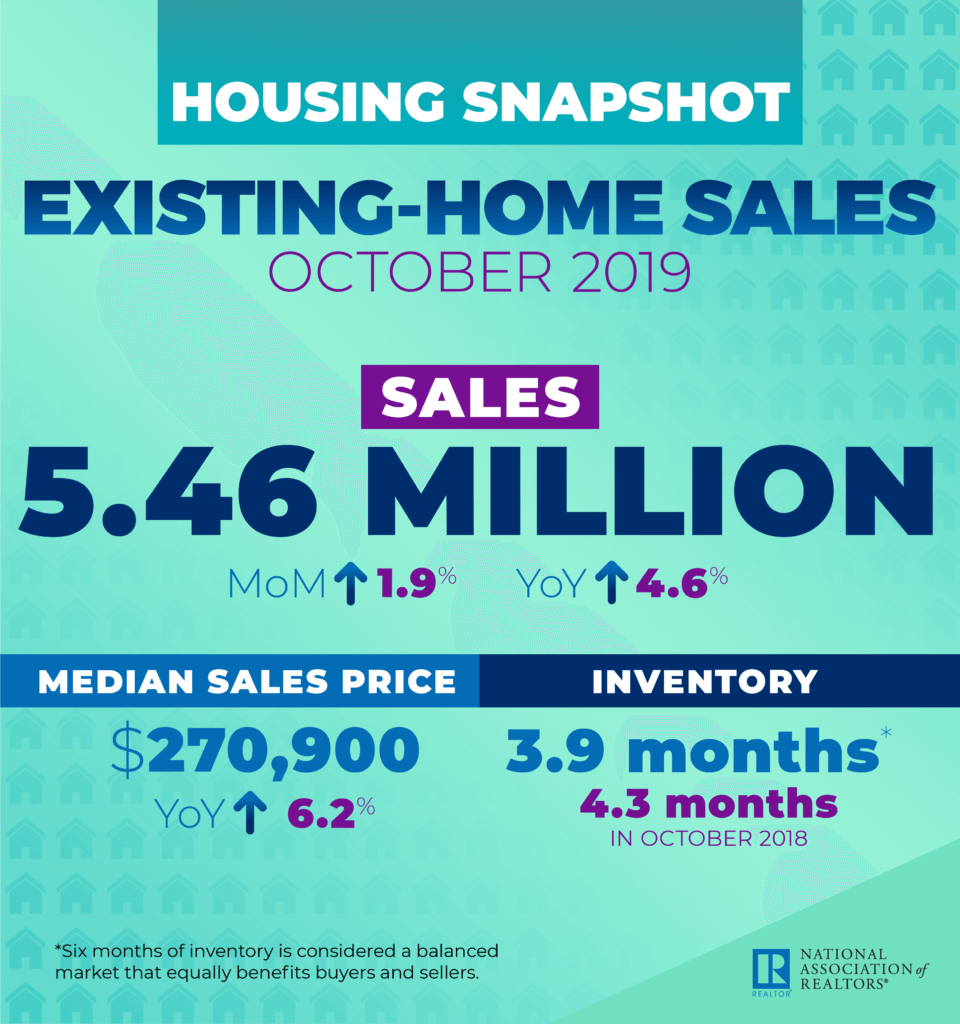

National Association of Realtors

December 1, 2019 Report Highlights: “October 2019 brought 5.46 million in sales, a median sales price of $270,900, and 3.9 months of inventory. The median sales price is up 6.2% year over year, and inventory is down 0.4 months from October 2018.”