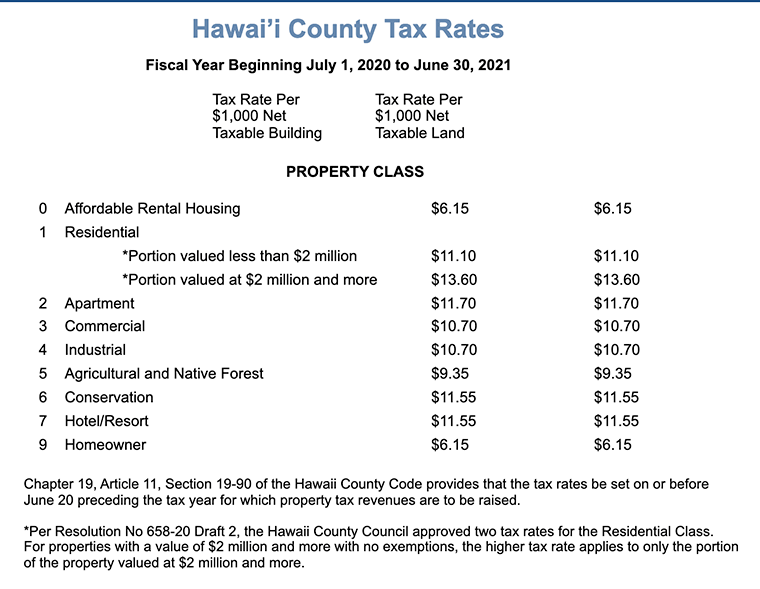

Hawaii County Property Tax Increase

The Hawaii County Council recently passed a new budget targeting “luxury real estate” valued at $2 million+. Most of these properties are located along the west side of the island near Kona and within the Kohala Coast Resorts. The County approved a budget and tax scheme raising taxes on secondary homes on the additional value, that exceeds $2 million, approximately 18.38% or $13.60 per $1000 in value. The first $2m will be taxed at the same rate as last year or $11.10 per $1000 in value. No additional taxes were passed for all other classifications even though gross taxes could increase as the County’s Tax Valuations continue to climb upward.

As an example, annual taxes on a $10 million home will increase by $20,000 to $131,000.

Source: Hawaii County Real Property Tax Office website.